From Uncertainty to Opportunity: Using Data to Guide Your 2023 Real Estate Strategy

Intro

The real estate market has been plagued by fear as demand from buyers wanes and supply increases. Over the past few years, historically low-interest rates fueled a surplus of liquidity in the financial system creating one of the strongest sellers’ markets on record. While this is true of the past, throughout 2022, many people have begun to realize the market conditions are no longer the same.

Throughout this synopsis, I will provide details on why this occurred and what buyers and sellers should look for in the future. Instead of flooding you with my predictions, I aim to equip readers with the facts and data they need to form their own opinions on the market. This report will mainly focus on South Florida’s real estate market, specifically Jupiter, FL. However, the insights and information provided will be valuable to readers, regardless of location.

Data for 2022

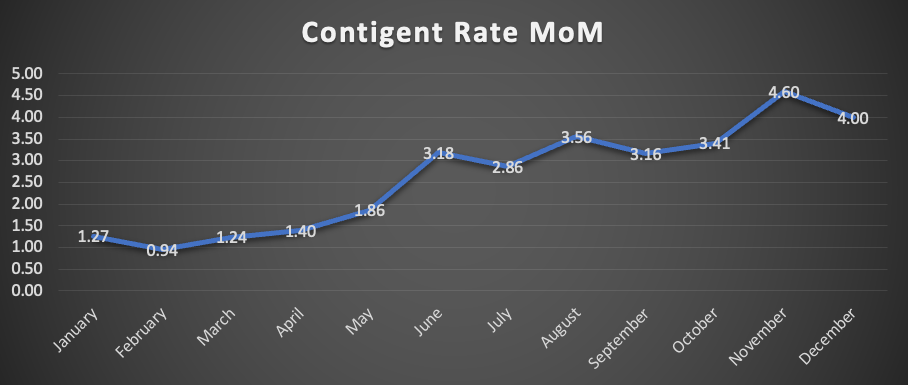

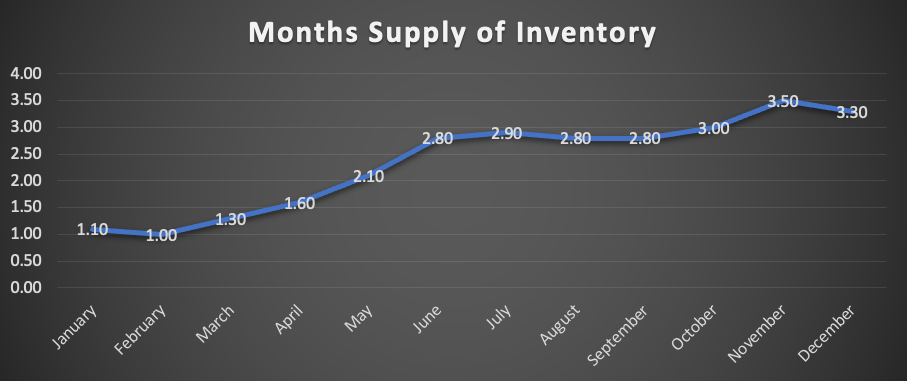

Below I have attached a chart depicting the contingent rate change month over month as well as the months’ supply of inventory for 2022. These charts were created from data strictly using single-family homes in Jupiter, Florida.

The contingent rate was calculated by dividing the active inventory by the number of homes under contract for that given month. Sometimes it can provide a glimpse into the future of the inventory's direction. For example, an increasing contingent rate would mean inventory will go up in the future because fewer homes are under contract. Conversely, a decreasing contingency rate could help predict an upcoming decrease in supply.

We have seen drastic changes in the real estate market year after year. For example, just from January to December of 2022, we have seen a 200% increase in the monthly supply of homes and a 27% decrease in the average home sales price.

Buyer’s Mindset

While most markets are driven by consumer emotion, these emotions are usually created by the financial conditions around them. Therefore, to make sound decisions we must analyze the data presented in the market and the effects it might have on buyers and sellers’ emotion. To start, we will examine the data regarding buyers. As most people know, the real estate market prices will be driven by supply and demand, so we must recognize where the demand currently stands and what these buyers might think.

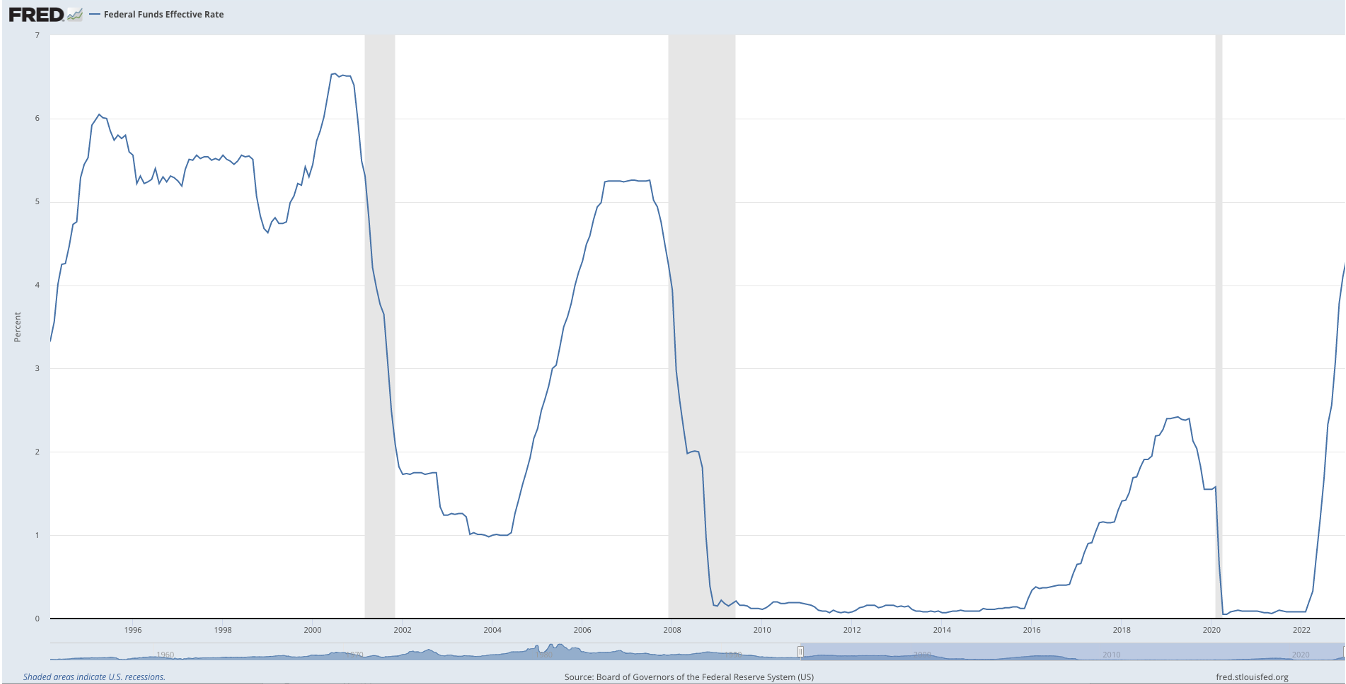

From an investor’s standpoint, they seem to remain patient as it has become more challenging to find deals that will cash flow. One of the main reasons for this challenge is primarily due to the Federal Reserve raising its benchmark rate at the most rapid pace since the early 1980s (as seen from the chart below).

Not only has the Federal Reserve made it difficult for investors to cash flow, but they have encouraged many to remain patient and sit on the sidelines. Investors can receive a 4-5% yield on short-term treasury bonds, basically risk-free, while receiving tax benefits in the process. This has made real estate less appealing, thus decreasing demand from investors.

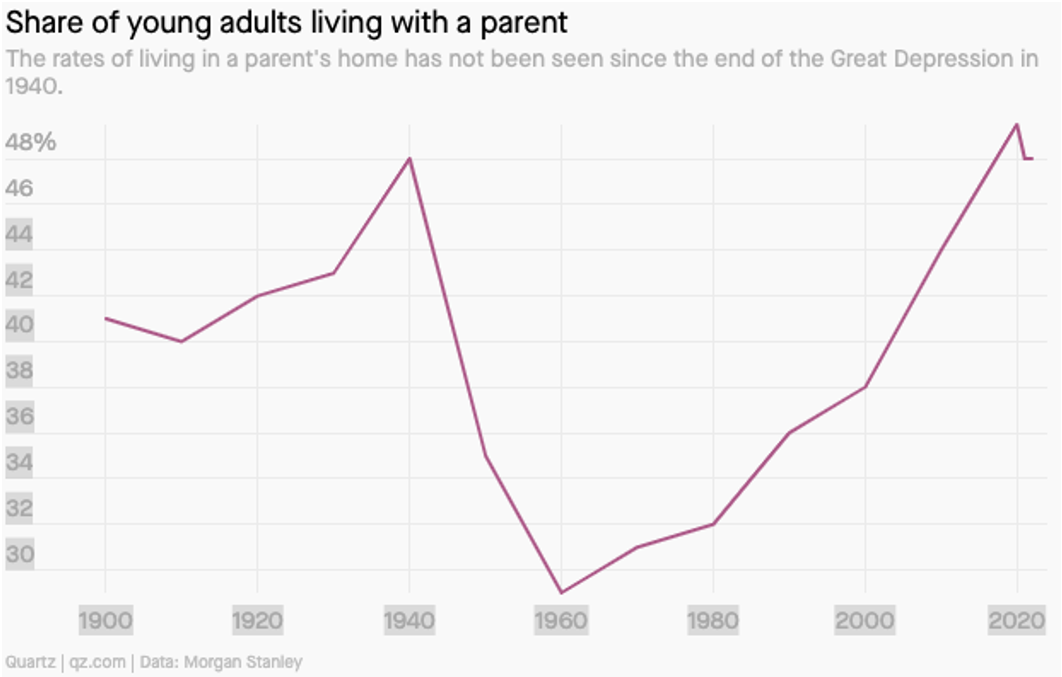

Not only does demand from investors seem to have slowed, but demand from the average consumer searching for a home has also decreased significantly. Interest rates have not just affected investors but have also made it difficult for consumers to even afford a home especially younger buyers. In fact, “nearly half of all young adults ages 18 to 29 still live with their parents” (Quartz).

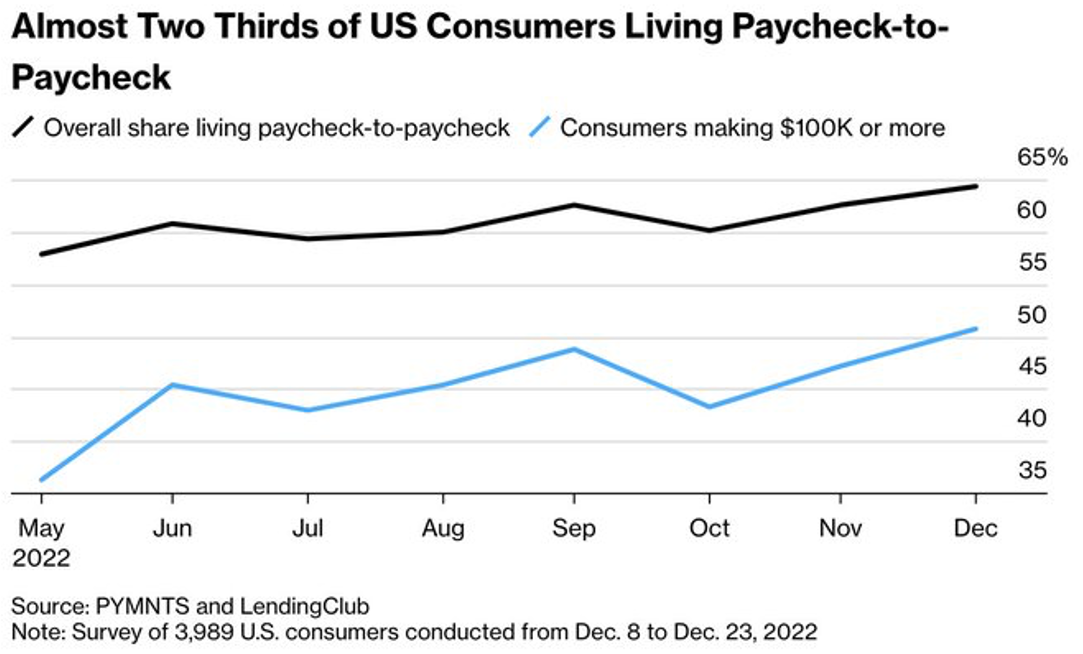

Interest rates are a sign that consumer affordability will be impacted in the future, but how is the current state of the consumer (buyer’s)? Using recent data, we find that many consumers are struggling. In fact, “64% of U.S. consumers said they were living paycheck-to-paycheck at the end of 2022, millions of whom were earning more than $100,000 a year.”

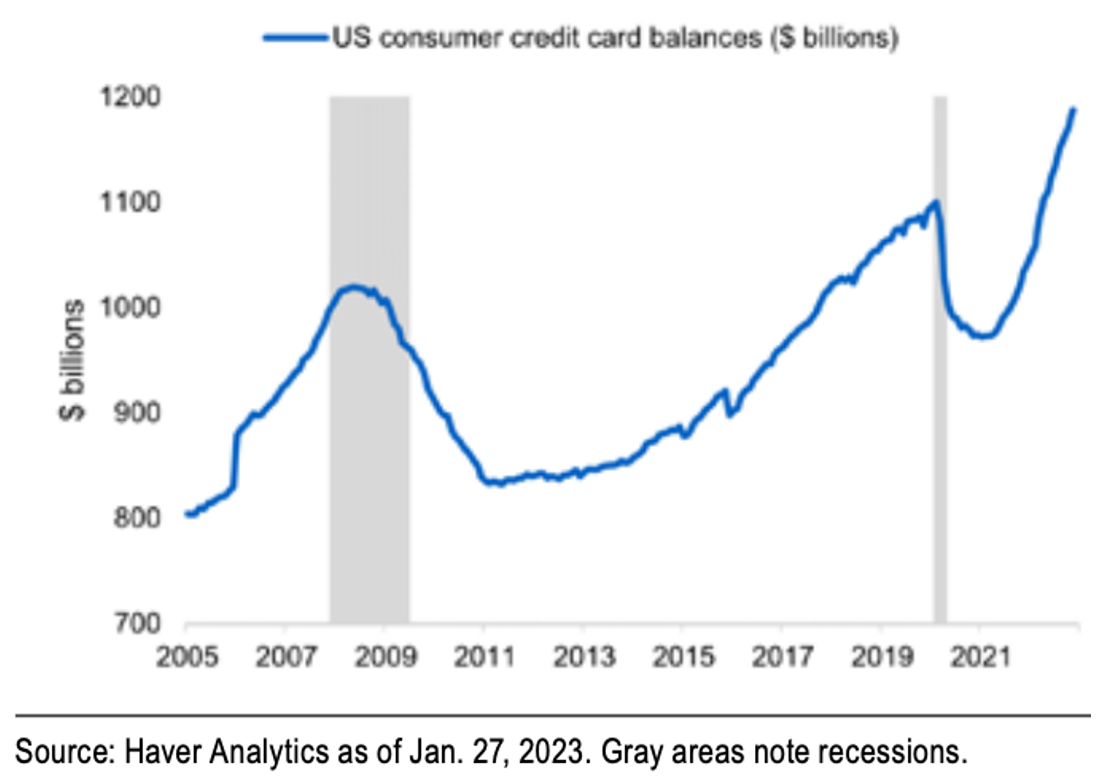

People living paycheck to paycheck are in no position to be buying homes any time soon. Their decisions to live paycheck to paycheck and lack of savings seems to have already begun reflecting in other financial markets. Right now, the U.S. consumer credit balance has reached an all-time high, and the lack of saving has shown that this has no sign of slowing down. In fact, it may prove to be very unsustainable

Seller’s Mindset

The question the readers must ask of the sellers is, if it is such a difficult time to buy, why would homeowners ever sell? Many homeowners have locked in excellent, fixed interest rates on their homes, incentivizing them to stay put. This could help keep supply numbers down, but for how long and to what extent?

The truth is many other factors play a role in the homeowners' thought process, and the tightening in financial conditions could force them to make decisions they otherwise would have never thought of doing. First, once these fixed-rate mortgages roll over or expire, many homebuyers will be put in a pinch since many did not consider this sudden rise in home payments. In addition, with the rapid rise in home values, property taxes have increased significantly for these homeowners. While many homeowners might have considered this change in expenses, most probably did not expect this significant of a change in this little amount of time. Over the long run, these negative effects could be reflected in the real estate market especially with the financial stress the consumer has been facing.

Outlook

The times ahead are uncertain, and no one knows what will happen to real estate prices in the future. Many of the matters lie in the hands of the Federal Reserve and the strength of the consumer.

Regarding the Federal Reserve, Jerome Powell has expressly stated he has no intention of cutting rates any time soon. While we have seen some drop in inflation, we are still well away from the Federal Reserve’s target of 2%. Without achieving their inflation goal, the Fed might decide to pivot in the chance they break something in the financial system, or the job economy becomes too weak. However, markets received some of the most substantial employment gains since July 2022, of 517,000. While this seems like great news, it is upsetting to say that the Fed does not want to see positive job data like this; they want the consumer to struggle and for the unemployment number to increase. Without the consumer’s struggle, demand will remain high, and the Fed will lose its fight against inflation.

Conclusion

As much as I wish to remain optimistic because everyone loves a bull market, there is no arguing that consumers have had a tough 2022. My goal is to stay current on the new data, so I can continue improving my financial literacy and help provide my readers with the essential information needed to be happy with their decisions and investments. A home is a significant asset, whether simply an investment or a place where you plan to spend several years of your life, and I want to be here to help you feel confident in your decision.

Considering this is my first article, I would love to hear feedback, and of course, I am always open to any opinions, thoughts, or topics you wish me to cover in the future. I could go on for hours about the financial markets, but I want to remain as concise as possible for the time being.

Remember that I tried to provide the data and keep my opinions to the side. However, markets tend to be forward-looking, and there is always the chance that they have already priced in the above-mentioned factors, so please try to formulate your own opinions.

Thanks for reading Kyle’s Substack! Subscribe for free to receive new posts and support my work.