The Home Market Rollercoaster: Exploring the Influence of Interest Rates on Property Values

Hello everyone,

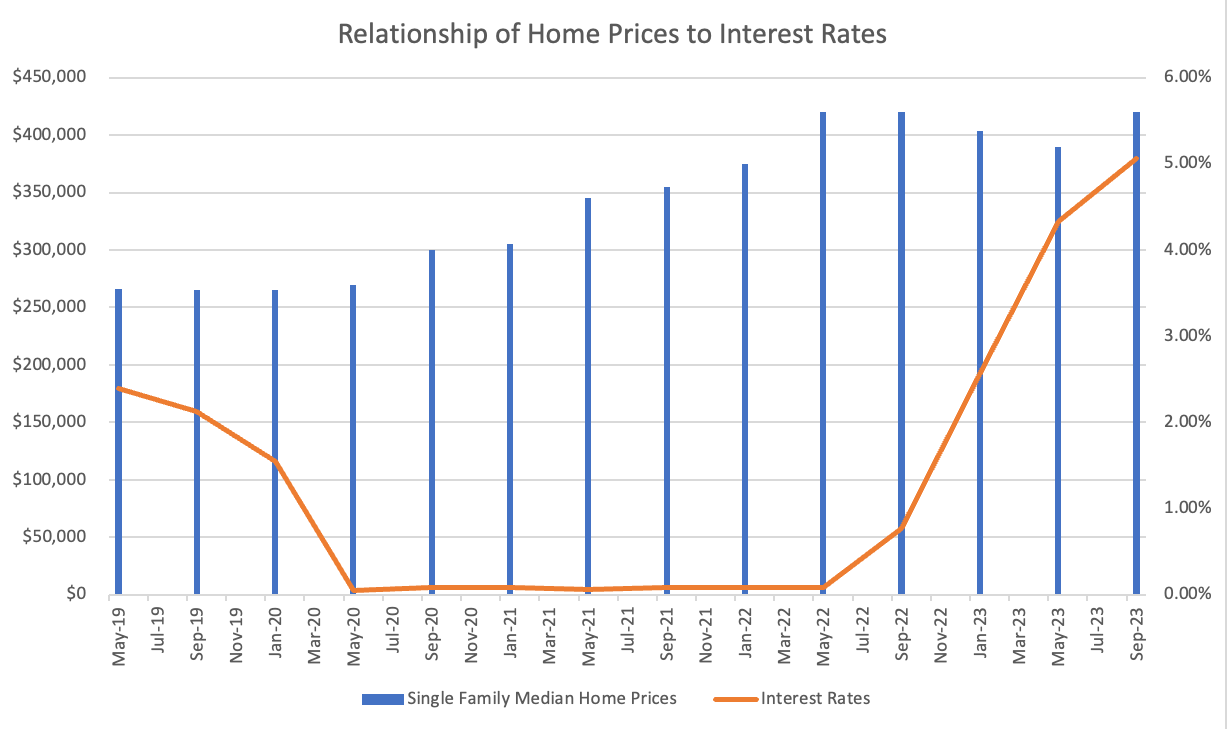

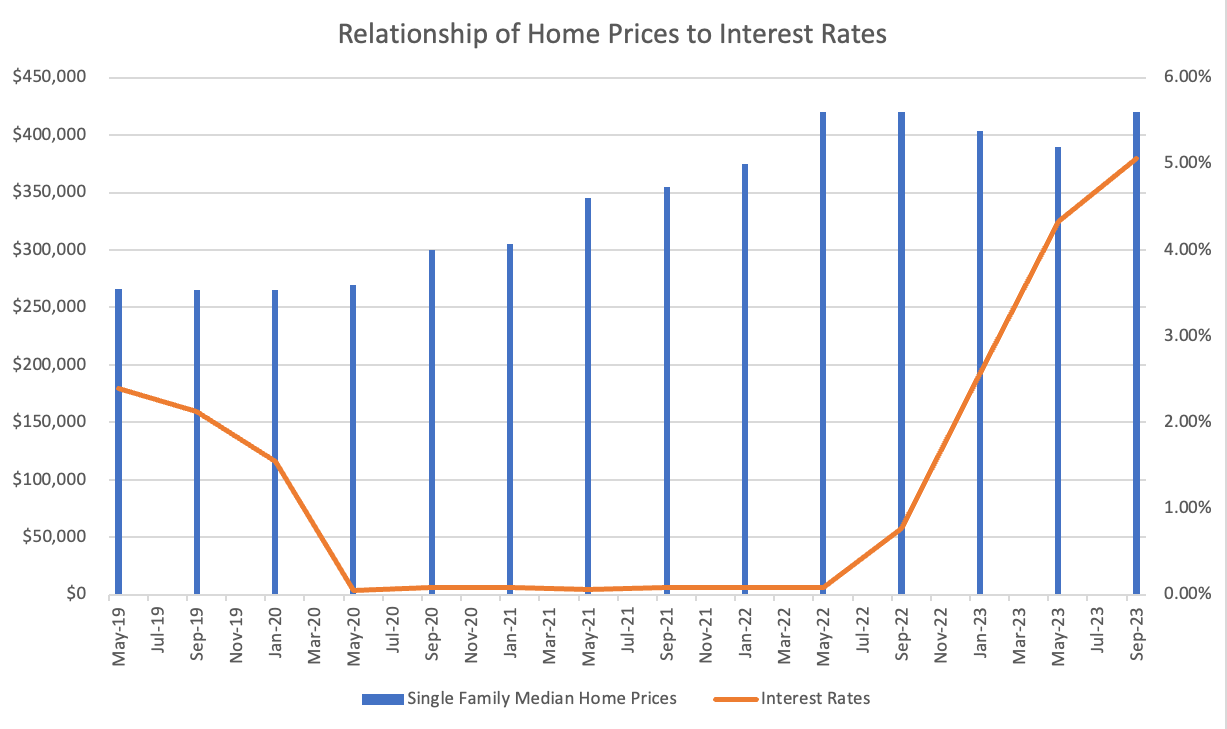

This week's newsletter dives deeper into last week's home prices and interest rates topic. To break it down further and better describe the effect of low-interest rates on home prices, I compiled quarterly data from the start of May 2019. I chose May 2019 because that was the highest period of interest rates over the last 10+ years.

As one can see from the graph, in May 2019, when interest rates were at their highest, median home sale prices were at their lowest. Home prices began to rise as the Federal Reserve cut interest rates in 2019 due to concerns over the Trade War and slowing global growth. For two years, the interest rates were kept below 1% while people just continued to buy and buy and buy. Why wouldn’t they, with debt at its cheapest levels ever? Once the Federal Reserve increased interest rates once more in response to the surge in inflation, home prices finally started to drop again until the most recent quarterly data. I believe we are seeing the data print an increase in home prices and interest rates due to buyers anticipating the Federal Reserve cutting rates and the low supply of homes that has not budged. It is essential not to time the macro and predict the Fed's decisions because the only person who knows what the Fed will do is themselves. Currently, the Fed has clearly stated that they plan to keep rates elevated for the foreseeable future and potentially hike rates even more.

What can a reader take from all this? As you can see from the graph, while interest rates are high is the time to buy a home if you are looking for appreciation. If one were to use strictly history and data to make decisions, they would buy when rates are high and sell when they are low. Take the data with a grain of salt, and only purchase if it makes sense for you and your strategy. I wanted to share this data because I found it fascinating and hoped it could benefit my readers.