Where is the crash?

Why have we not seen as significant of a drop in home prices as many expected? This has been such a fascinating market that we have witnessed these past couple of years. Almost everyone expected a significant drop and real estate markets to crash, but most have been left still waiting. Since the start of the year, there has been a slow uptrend in home prices, and many buyers waiting on the sidelines have decided to enter the market. These markets have priced out a lot of individuals, especially most individuals under 30. We have seen commercial real estate, specifically office buildings, take a significant hit due to large vacancies, especially in places like New York. We have also seen declines in residential home prices in most areas, but South Florida has barely been affected. I will admit things are slower than two years ago. However, prices have barely dropped, especially compared to the increase over the past few years. Many homes have increased by over 50% in the past couple of years, while in the past year have only declined 5-10%. In fact, according to the data from the Florida Realtors, single-family median home sale prices in Jupiter are only down 3% over the past year. With the rapid increase in mortgage rates, buying has decreased pricing out many buyers, but why are prices failing to drop? What is going on?

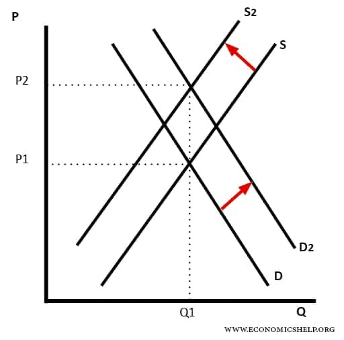

The short answer is a lack of inventory. The Federal Reserve has created a new form of inflation within the real estate market. The Federal Reserve’s tools are focused on controlling demand, not necessarily supply. Their increase in interest rates has helped decrease the number of buyers, but that means nothing when it is also decreasing supply. As you can see from the graph below, they counteract each other and can create stagnant or increased prices depending on if the decrease in supply is more significant than the decrease in demand. Due to this, the Fed has failed to destroy inflation within the housing market, which has been the reason for much of the struggle.

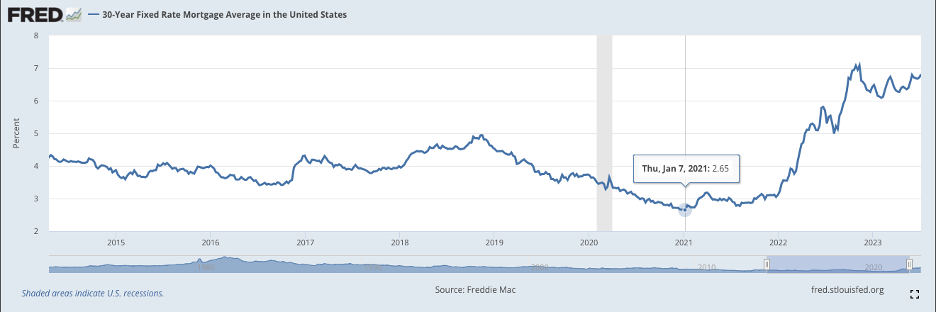

The reason for the decrease in the supply of housing is because of the super-low mortgage rates they provided for almost two years. Many home buyers have locked in 2-3% interest rates when buyers now pay around 7%.

Why would someone sell their home to buy another one at an interest rate over double what they are currently paying? Not to mention the arbitrage opportunity the Fed has created for many home buyers. Most homebuyers can have the government pay their mortgage by investing in short-term Treasury bills. Short-term treasury bills are currently yielding over 5%, while these home buyers have a mortgage rate of 2-3%. Pretty crazy market the Fed has created, and the opportunities they have provided over the past couple of years to build wealth.

For further details on this topic, do not hesitate to reach out!